Learn about the importance, and benefits, of US bank routing numbers in ensuring secure and efficient financial transactions.

In the cutting edge monetary scene, productivity and security are central. Among the heap of components that guarantee smooth financial activities, US Bank Routing Numbers stand apart as pivotal identifiers. Routing numbers, otherwise called ABA numbers or routing travel numbers, assume a fundamental part in the financial framework in the US. These nine-digit codes are instrumental in coordinating the progression of cash between banks, guaranteeing exchanges are handled precisely and productively. This article investigates the meaning of US Bank Routing Numbers, featuring their significance, usefulness, and the positive effect they have on the two people and organizations.

Grasping US Bank Routing Numbers

US Bank Routing Numbers is a nine-digit code that recognizes a specific money related establishment inside the U.S. The American Agents Alliance (ABA) spread out these numbers in 1910 to streamline the most well-known approach to orchestrating and passing paper keeps an eye on to the right banks. While the financial business has developed essentially from that point forward, routing numbers stay a basic part of the monetary framework.

Routing numbers are fundamentally utilized for three sorts of exchanges:

- ACH (Robotized Clearing House) Transfers: These incorporate direct stores, bill installments, and other electronic exchanges.

- Wire Transfers: These include moving cash starting with one bank and then onto the next, frequently for critical sums or global exchanges.

- Check Processing: Routing numbers guarantee that checks are handled and shipped off to the right banks for installment.

The Gainful Result of US Bank Routing Numbers

- Streamlined Trades: One of the major advantages of US Bank Routing Numbers is the proficiency they bring to financial exchanges. By giving an interesting identifier to each bank, routing numbers assist with guaranteeing that cash is moved to the right organization rapidly and precisely. This is especially significant for robotized exchanges, for example, direct stores and bill installments, which depend on exact routing data to easily work.

For example, when a business processes finance, they utilize the routing quantities of their representatives’ banks to guarantee that wages are kept into the right records. This dispenses with the requirement for manual mediation, decreasing the gamble of blunders and postponements. Additionally, when people set up programmed bill installments, routing numbers guarantee that installments are shipped off the right lenders on time, trying not to late charges and keep up with great FICO ratings.

- Enhanced Security: US Bank Routing Numbers likewise assume a vital part in upgrading the security of monetary exchanges. By giving a normalized framework to recognizing banks, routing numbers assist with forestalling misrepresentation and guarantee that cash is moved securely. This is especially significant in the computerized age, where digital dangers are a consistent concern.

For instance, while setting up an immediate store, people should furnish their bank’s routing number alongside their record number. This data is then checked by the getting bank to guarantee that the exchange is genuine. Also, while making on the web buys or moving cash between accounts, routing numbers assist with confirming the validness of the exchange, lessening the gamble of misrepresentation and wholesale fraud.

- Facilitating Worldwide Transactions: While routing numbers are fundamentally utilized inside the US, they likewise assume a part in working with global exchanges. Numerous U.S. banks have explicit routing numbers for global wire moves, which assist with guaranteeing that cash is moved precisely and effectively across borders. This is especially significant for organizations that work worldwide, as it permits them to pay providers, representatives, and different partners in various nations.

For example, a U.S.- based association that imports stock from Europe could use overall wire moves to pay its suppliers. By giving the right steering number, the association can ensure that the portion is delivered off the right bank, avoiding delays and probable discussions. This smoothes out the installment cycle as well as helps fabricate trust and keep up areas of strength for with connections.

- Simplifying Monetary Management: US Bank Routing Numbers additionally improve on monetary administration for the two people and organizations. By giving a normalized framework to distinguishing banks, routing numbers make it simpler to deal with numerous records, track exchanges, and accommodate explanations. This is especially significant for organizations that handle enormous volumes of exchanges, as it guarantees that cash is designated accurately and accounts are adjusted.

For instance, a business person with different records could use steering numbers to move cash between accounts, deal with bills, and collaboration finance. By using the right steering numbers, the owner can ensure that each trade is dealt with unequivocally and capably, decreasing the bet of bumbles and further creating pay the chiefs. Also, individuals can use directing numbers to set up customized moves among speculation reserves and monetary records, enhancing their money related organization and helping them with achieving their venture finances goals.

The Job of US Bank Routing Numbers in the Computerized Age

As the financial business keeps on developing, routing numbers stay an essential part of the monetary framework. While innovations, for example, blockchain and computerized monetary standards are changing the manner in which we go through with exchanges, US bank routing numbers keep on giving a solid and secure strategy for moving cash between banks.

- Combination with Cutting edge Financial Stages: Lately, the climb of cutting edge monetary stages has transformed how we manage our assets. From flexible financial applications to online portion benefits, these stages offer an extent of supportive features that make it more direct than at some other opportunity to get to and manage our money. Routing numbers assume a vital part in the usefulness of these stages, guaranteeing that exchanges are handled precisely and proficiently.

For instance, while connecting a financial balance to a versatile installment application, clients should give their bank’s routing number to confirm the record. This permits the application to start moves, process installments, and give ongoing record data. Additionally, while setting up programmed bill installments or direct stores through web based financial stages, routing numbers assist with guaranteeing that cash is moved to the right records, diminishing the gamble of blunders and postponements.

- Supporting Monetary Inclusion: US Bank Routing Numbers likewise assume a part in advancing monetary consideration by making it simpler for people to get to banking administrations. By and large, people who might not approach customary financial administrations can in any case partake in the monetary framework by utilizing advanced financial stages and installment benefits that depend on routing numbers.

For instance, pre-loaded charge cards frequently use routing numbers to work with direct stores, permitting people without conventional ledgers to get compensation, government benefits, and different installments. This not just gives a solid and advantageous technique for getting to reserves yet additionally advances monetary security and freedom.

Difficulties and Contemplations

While US Bank Routing Numbers offer various advantages, there are additionally a few provokes and contemplations to remember. One of the essential worries is the potential for mistakes while entering routing numbers, which can prompt postponements, misled reserves, and different issues. To alleviate this gamble, it is fundamental for twofold check routing numbers and guarantee that they are placed accurately.

Another thought is the need to safeguard delicate monetary data. While routing numbers are all around seen as safeguarded to share, they are a significant part of the time used connected with other fragile information, for instance, account numbers. Consequently, it is basic to take the necessary steps to shield this information and ensure that it is simply bestowed to trusted parties.

Conclusion:

With everything taken into account, US Bank Routing Numbers expect a basic part in the money related system, giving a trustworthy and secure strategy for moving money between banks. From smoothing out exchanges and improving security to working with global exchanges and working on monetary administration, US Bank Routing Numbers offer various advantages for people and organizations the same. As the financial business keeps on developing, routing numbers will stay a basic part of the monetary framework, guaranteeing that exchanges are handled precisely and productively in the computerized age. By figuring out the importance and convenience of US Bank Routing Numbers, we can all the more promptly esteem their work in progressing money related unfaltering quality and security.

FAQ’s:

- What is a U.S. bank routing number, and where could I anytime track down it?

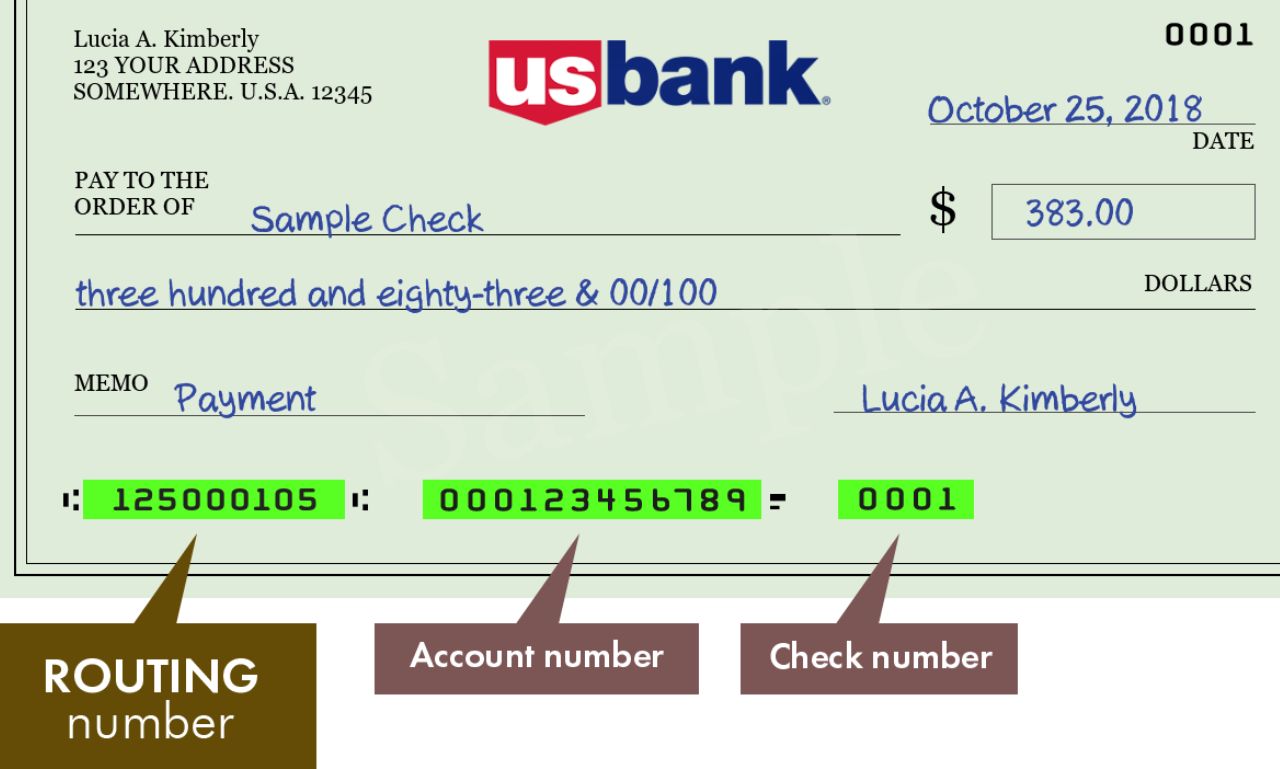

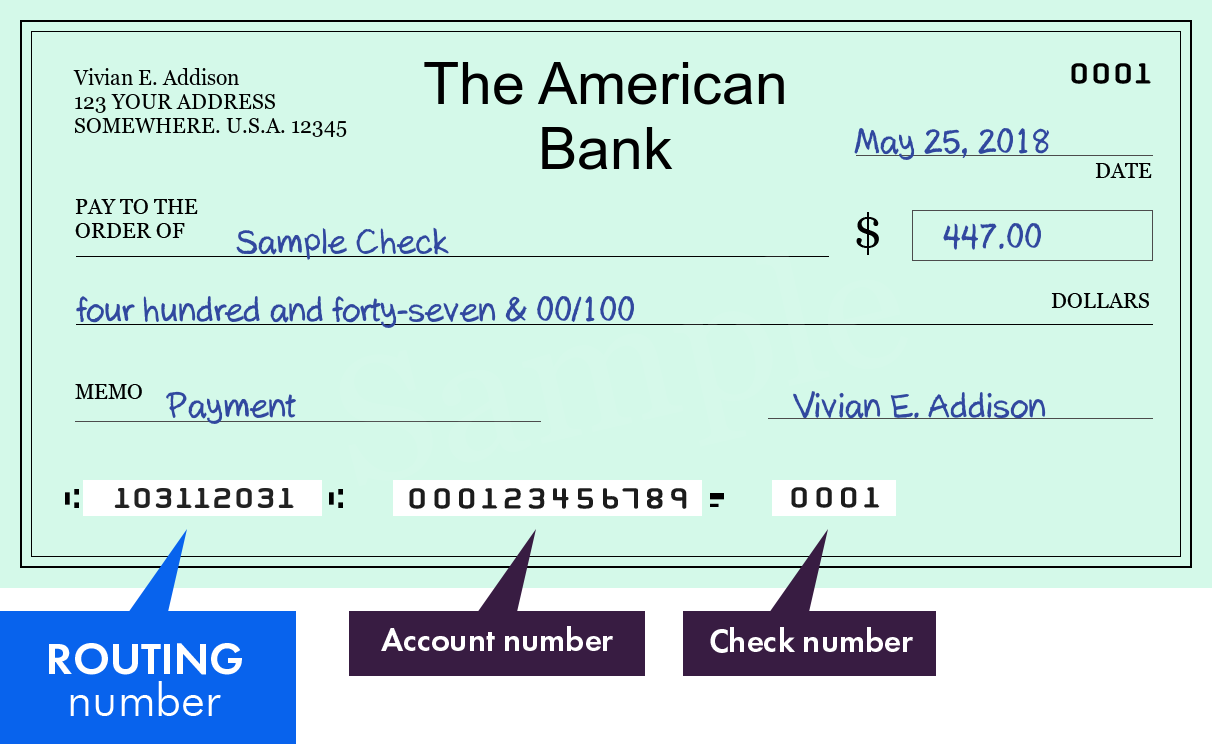

US Bank Routing Numbers are a nine-digit code used to recognize a specific financial association in the U.S. It is key for taking care of various kinds of financial trades, including ACH moves, wire moves, and checks to deal without. You can find your bank’s directing number in a couple of spots:- On the base left corner of your checks.

- – By signing into your web-based financial record and checking the record subtleties area.

- – On your bank’s true site.

- – By reaching your bank’s client support office.

- How can I say whether I’m utilizing the right routing number for my transaction?

To guarantee you are utilizing the right routing number, follow these means:

- – Confirm the routing number with your bank, particularly if you are setting up a significant exchange like a wire move or direct store.

- – Twofold check the routing number imprinted on your checks assuming you are involving it for actually taking a look at handling.

- – For online exchanges, allude to the routing number given in your web-based financial record or on the bank’s true site.

- – In the event that you are uncertain, contact your bank’s client assistance to affirm the right routing number for your particular exchange.

- Are routing numbers something very similar for all parts of a bank?

No, routing numbers can change between various branches or locales of a similar bank. While certain banks utilize a solitary routing number for all exchanges cross country, others might have different routing numbers for various states, locales, or sorts of exchanges, (for example, paper really takes a look at versus electronic installments). It’s critical to confirm the right routing number for your particular exchange and area.

- Can I utilize a routing number for worldwide transactions?

Routing numbers are essentially utilized for exchanges inside the US. For worldwide exchanges, U.S. banks frequently utilize Quick codes (otherwise called BIC codes) all things being equal. In any case, some worldwide wire moves might require a U.S. bank’s routing number notwithstanding the Quick code. It is ideal to check with your bank for the specific essentials and nuances expected for worldwide trades to ensure precision and avoid delays.

- What might it be fitting for me I do if I enter some unsatisfactory U.S. Bank routing number for an exchange?

In case you enter some unsatisfactory routing number for a trade, the resources may be conceded, misdirected, or returned to your record. You ought to do this:

- – Contact your bank or the foundation taking care of the exchange promptly to advise them regarding the mix-up.

- – Give the right routing number and some other vital data to assist with amending the mistake.

- – Screen your record to guarantee the exchange is handled accurately and check for any expenses or accuses related of the mistake.

- – On account of repeating exchanges, update the routing number speedily to keep away from future issues.